Eugene looks at short list of revenue options

9 min read

The city council hears more details from the revenue committee, focused on filling the budget gap—which has grown from $8.3 million to $12 million. On Feb. 26:

Sarah Medary (Eugene city manager): We have four main problems to solve. The first one is our critical funding gap, which we are all very familiar of: the revenue plug that we put in this biennium. So this is money we have to find starting in July. At the time we plugged in $8.3 million. We know that number is higher.

[00:00:30] The second one are what we call ‘areas at risk.’ These are the services that are currently funded with one-time dollars—we don’t have a future for them. And some of that is some of our work around homelessness.

[00:00:42] (3) New and or expanded services—more work around housing or work around climate, potentially new fire station.

[00:00:49] And then, for me, what I call the fourth problem, solutions that are really sustainable for us in the long term and work together and don’t overly impact any one area of our community.

[00:01:00] John Q: With a list of the challenges ahead, Chief Financial Officer Twylla Miller.

[00:01:05] Twylla Miller (Eugene chief financial officer): Our most immediate financial need begins this July. We’re looking at an approximate $12 million gap over the next two years.

[00:01:13] We are still in the process of rebuilding our reserves coming out of the pandemic. So new revenues, possible reductions, and then potential bridge strategies as we look to the future, will be necessary as we come into the second year of the biennium, which begins this July.

[00:01:29] And these adjustments are needed to keep funding our ongoing service level.

[00:01:36] Unhoused services, we primarily funded with ARPA funds from the federal government and state funds. Without funding from our partners, current service levels will end at the end of the biennium, so the gap would begin in July of 2025.

[00:01:51] We’ve used opioid funds this biennium for our Human Services Commission (HSC) funding. We do not have funds identified past this biennium in our long-term financial forecast for HSC. So that gap would begin in July of 2025.

[00:02:07] Our library levy will expire in June of 2026. It’s currently set at $2.85 million. If we were to continue with a levy, we would go either in November of 2025 or May of 2026. And likewise, with our Parks and Rec levy currently set at $5.33 million, we would need to take action by May of 2028.

[00:02:27] Our community safety payroll tax funds $23.6 million, and under the current ordinance, funding would need to be continued through a vote of the people by November of 2028 to continue that service.

[00:02:40] Animal services would potentially be at risk if ongoing funding weren’t identified.

[00:02:44] Newer services to our portfolio—affordable housing trust and sustainability efforts—have been funded either with limited-duration funding or in some cases, some ongoing funding, but not necessarily at the level that the community would desire for these services. And additionally, as our community grows over time, service expansions for existing services will continue to grow, such as a new fire station.

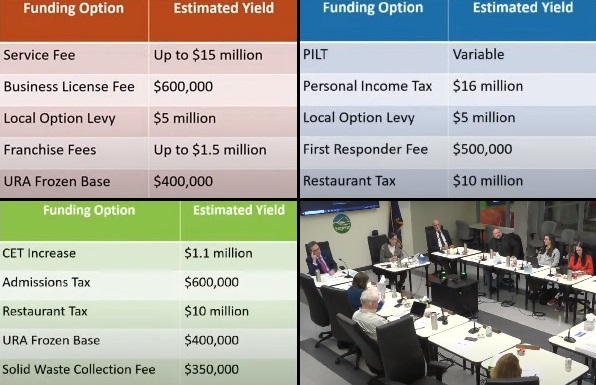

[00:03:09] John Q: She said the revenue group focused on the near term, and several ideas bubbled up to the top, including a variety of fees, an admissions tax, and a personal income tax.

[00:03:21] Twylla Miller (Eugene chief financial officer): We asked the group to consider a range of criteria, including how much revenue would be generated; the impact on taxpayer; what the administration efforts and collection efforts would be; and also the impact on community, among other things.

[00:03:34] Service fees are used broadly across the state to recover all or a portion of service provided. These fees are billed to occupants of a developed property. The group felt that this option makes sense if tied to specific services currently provided by the city and not based as a broad or general fee and that this source would be sustainable over time.

[00:03:55] A business license fee also had general support, particularly if the revenues were used to support economic development and a healthy business climate and support the business community.

[00:04:04] And then the local option levy, which is a five-year measure for operating expenses, was identified here as a possible bridge strategy in the event that more time was needed to develop a long-term strategy. So it could be a bridge in the short term, even though it isn’t sustainable over the long term.

[00:04:19] The franchise fee made sense here to the group, but it had a stronger nexus for much of the group to new services, particularly as it relates to climate work.

[00:04:27] And finally, while increasing the frozen base option was considered viable, we are already implementing this as part of the current budget. And this additional $400,000 would be an expansion to that measure. And it was noted by the group that it could potentially create timing implications to projects in the urban renewal districts.

[00:04:46] A PILT or a Payment In Lieu of Tax—it’s a payment made by a tax-exempt entity, such as a government or nonprofit, to compensate for some of the costs of providing municipal services to these entities, as they don’t pay property taxes. Agreements would need to be reached with the University of Oregon to enact this option. And they felt that it should only be pursued on a larger scale across all nonprofits.

[00:05:10] There was quite a bit of interest actually in a personal income tax, specifically on high-wage earners. While this could be used for any purpose, there was an interest to use this for unhoused services, and that resonated with quite a bit of the group.

[00:05:24] It was noted that we could use a local option levy to provide services as needed for parks and libraries until a more permanent solution was found.

[00:05:31] And then also a first responder fee, to recoup costs related to providing services to emergency responses.

[00:05:38] And then the restaurant tax was identified here as a potential alternative to a community safety payroll tax (CSPT), if funding isn’t renewed in the future. General concerns with a restaurant tax were the impact on restaurants in the current economic environment, and then also to the low-income population in the community, as this is a challenging time. But they felt that it could potentially be used in that event of the CSPT not moving forward.

[00:06:06] In 2018, the Oregon constitution was amended to allow local governments to issue G.O. (general obligation) bonds to finance the cost of constructing affordable housing, including when funds go to a nongovernmental entity.

[00:06:18] Climate impact fees are a one-time fee charged to mitigate the impact of emissions created through development-related activities. And these fees have been used to help communities invest in projects that lower our community’s greenhouse gas emissions and could potentially be used for sustainability efforts.

[00:06:35] Construction excise tax: This would raise the construction excise tax from a half a percent to one percent with revenues going towards affordable housing.

[00:06:44] A tax on admissions to events: Many communities have admissions taxes.

And then finally, with the solid waste collection fee, there was some concern that this could disproportionately impact another fee or another rate increase could disproportionately impact low-income community members.

[00:07:01] Councilor Matt Keating: I really appreciate the wide breadth of suggestions that are potentially on the table. Admissions tax, for example. There’s a lot of enthusiasm around that piece in circles I run in, but also a lot of concern that it would not hurt small businesses that have patrons of, let’s say, less than 100 persons, or like a small concert or a movie theater, like the Art House or the Broadway Metro.

[00:07:30] It wouldn’t really make sense to have that kind of admissions fee, I would think, for those small, small businesses, but it would make sense for, like, a concert at the McDonald or a basketball game at Mac Court.

[00:07:43] You know, of the 60,000 people that would attend like a game at Autzen, I would wonder: What percentage of them are coming from outside of our area? And I would guesstimate, back-of-the-napkin math, it’s probably half (At least). Yeah. So, I look forward to those conversations with the University.

[00:07:58] Was there conversations around Airbnb and short-term rentals?

[00:08:02] Were there conversations around rental vehicles? I recently went to Southern California and rented a car online because Budget said $29 a day. I jumped on it. When I went to pick up the vehicle, there was an additional $71 in taxes, so the county of Los Angeles squeezed me. What are we doing to perhaps glean some revenue from the crowd that would be renting vehicles in our city streets?

[00:08:31] And then finally, the communities of Boulder, Colorado, Washington, D.C., Seattle, Berkeley, Oakland, San Francisco, Albany, New York have all initiated some semblance of a soda tax that can generate anywhere from $1 million to $75 million, $1 million in the low end if you’re a Berkeley, to $75 million if you’re a Philadelphia.

[00:08:53] What was the conversation if any about a high fructose corn syrup, sugary beverage tax?

[00:09:01] Councilor Alan Zelenka: You need, I think it’s something like, three Valley River Centers worth of investment in the city to get $1 million. So, a great strategy to focus on for jobs and other things, but not to fill the short-term revenue strategy.

[00:09:15] And then the other part of that conversation that we had was the administrative-effort-to-revenues ratio. So some of the things are great ideas, but they take so much effort and they get so little money, they don’t help us solve the problem because the problem is so big.

[00:09:33] And we need to net millions of dollars. So the ones that got focused on, the ones that moved the higher priorities for the next kind of round and stuff, were the ones that could net a significant amount of money that could help solve the revenue problem.

[00:09:48] And we had numerous conversations about the University of Oregon and how they play into all this. And we really haven’t had conversations with them about any of this, so all that kind of conversation about what they can do, whether or not we can tax football games or basketball games or other kinds of things using their facilities, is a conversation that probably needs to occur, but it wasn’t really right for, again, because of the timing, because of the revenue need that we have is real short term.

[00:10:16] Councilor Mike Clark: We pay for local government predominantly with property taxes. That’s where the grand majority of the money comes from, from property taxes. Now, the people of the state of Oregon have said, ‘We’re not going to let you increase the rate that you tax on land.’ They’ve decided to limit that rate, but what they haven’t ever limited is the amount of land.

[00:10:40] It’s always a question to me why we don’t have that conversation because this community has never added land to the city. Now we’re going to add people. And it seems like we’re spending more and more money per person that lives here, but we don’t tax people.

[00:11:01] As our population has grown and our budget has grown over time, it would be interesting to me to see how much we spend per average person or group of persons in our city. In other words, how much we’re spending on a per-resident basis over time, whether we’re spending more for the number of people who live here or less, would be an interesting statistic to get sometime.

[00:11:29] And lastly, I’d love to have a tool that we don’t have: How can we tell whether our expenditures as a city organization are sustainable or unsustainable? The growth of our expenditures, because we’ve grown in the amount we’re spending in the last several years. And I want to ask the question: Are we growing at a sustainable level?

[00:11:54] And I’d love to have more feedback on: Where’s that tool? How do we know that?

[00:11:59] John Q: Just in case, city managers are preparing contingency plans to make cuts.

[00:12:06] Sarah Medary (Eugene city manager): I think most of us, including the advisors, are very concerned about the critical kind of right-in-front-of-us gap. The exec team is deep in that, and they have been for weeks trying to determine, ‘Okay, if we have to make those cuts, where are we going to make them?’

[00:12:20] John Q: Revenue discussions are continuing as the city waits to see if Eugene will get any funding help from the state. The legislative session ends March 10.