With wildfire season starting, review your renters or homeowners insurance

15 min read

With wildfire season approaching, whether you rent or own your home, this is a great time to think about insurance.

From the KEPW News archives, experts from government and industry speak at the UO during the 2023 Oregon Summit on Wildfire Recovery. Studies show that many people are significantly underinsured. President of the Northwest Insurance Council, Kenton Brine.

Kenton Brine (NW Insurance Council): My name is Kenton Brine and I serve as president of the Northwest Insurance Council. And our primary mission is to provide information about home, auto, and business insurance in Washington, Oregon, and Idaho.

[00:00:36] I want to give just a little bit of a primer about homeowners insurance generally. So property and casualty insurance refers to like insurance that’s for your home or your business or your car, it’s liability insurance, it’s umbrella policies. It’s not health insurance and it’s not life insurance.

[00:00:54] A quick primer on homeowners, mobile home and renters policies: A homeowners and mobile home insurance policy covers damage or loss to your home or its contents from theft or fire or wind or other storm damage or other ‘covered peril.’ And this is an important term, this insurance term ‘covered peril,’ cause there are some things that homeowners insurance policies do not cover.

[00:01:16] A key difference between homeowners, mobile home coverage and renters coverage: When you have home insurance or mobile home insurance, the policy is intended to cover the structure and its contents. Renters insurance just covers your possessions inside a rented space.

[00:01:32] Both those policies, whether they’re homeowners or renters, covers your things wherever you are. So if you have a laptop in your car that’s stolen, it isn’t your car insurance that covers it, it’s your homeowners or renters policy.

[00:01:43] These policies, importantly, also come with deductibles. In the case of homeowners insurance, it’s typically a percentage of the total value of your policy, so that’s going to be somewhere between, say, $1,500 and $3,000, depending on the total, or even higher, depending on the value of your home and how much it’s insured for.

[00:02:01] And a key difference between homeowners insurance and mobile home insurance is that with homeowners insurance, you can usually buy either ‘actual cash value’ coverage, which replaces the value of your home to rebuild it up to a certain amount, or you can buy ‘replacement cost coverage,’ which escalates over time to keep up with inflation and higher building costs.

[00:02:24] A startling number of people do not have replacement cost coverage even though they could get it, and then they find out the period of time between when their home was built and the time of the loss, there’s been a significant increase in the cost of replacing your home. Then they end up uninsured. That’s not something insurers want to see.

[00:02:40] So those of you out there have homeowners policies, ask your insurance agent or broker or your company about whether your home qualifies for replacement cost coverage. Take a look at that because it’s a good idea to know what those costs are and how it can benefit you.

[00:02:55] With a mobile home coverage, typically replacement cost coverage is not available. You only can get actual cash value coverage because homes increase in better value over time. Mobile homes do not. The property around the mobile home may increase in value, but the mobile home is a depreciating asset. So it’s difficult, if not impossible, to find replacement cost coverage for mobile homes.

[00:03:16] And I know that’s been a problem for people in Oregon where there was a wildfire that decimated so many hundreds or thousands of mobile homes. And that’s a significant issue.

[00:03:26] So again, renters coverage is a little bit different. Of course, it’s much cheaper than homeowners insurance coverage, it has much lower deductible, but it covers less, because it’s only intended to cover, like, when my daughter went here to the University of Oregon, we had a renters policy for her, it cost $115 a year, and it covered up to $30,000 of her stuff, which fortunately we never had to file a claim, so that was good. Unlike her car policy, well, we don’t need to get into that, two cars later…(laughter).

[00:03:52] I did want to mention the things we don’t cover: flood, earthquake, those are not covered perils. Earth movement—whether it’s a sinkhole or a landslide—typically not covered. Those coverages are available, but they’re not included in your homeowner’s policy. So if you’re concerned about that kind of insurance coverage for your home or property, you need to check with your insurance company that can steer you to where to find those kinds of coverage.

[00:04:17] Okay, now let’s talk about some challenges in the insurance market generally for their folks in Oregon and across the country. Some of the challenges for property owners are around the issues of availability and affordability. Availability is when you can’t find insurance, because maybe your policy has been nonrenewed by your company, or it’s just not available for some reason where you live.

[00:04:40] Affordability, of course, is how much you have to pay for the premiums. Unfortunately, right now, across the country, in certain areas of the country, in particular, California, Florida, to a certain degree Oregon, and Washington, Texas, there are swaths of places where insurance is becoming very expensive or impossible to obtain. And that is because insurers are also facing significant challenges.

[00:05:04] Some of those challenges for insurers include inflation, claims and repair costs, the cost of natural disasters, and the cost of reinsurance. And I’ll go just really quickly through each of those.

[00:05:16] Costs for rebuilding. I mentioned before how much it can change for an individual homeowner. But this is happening across the nation. I was just talking to TK (Keen, administrator of the Oregon Division of Financial Regulation) before we came in about a stat I ran across when I was preparing for this presentation. One of the biggest factors right now in home construction is that the home construction industry is missing about 340,000 people who used to work in that industry that don’t work in it anymore.

[00:05:41] So at a time when Oregon and other states are struggling to even try to approach an era of keeping up with the demand for housing, they don’t have enough people to do the jobs and all those delays in construction result in higher costs.

[00:05:55] In addition to that, building materials themselves: lumber, asphalt for roofing shingles, all the things that, cement, concrete, all the things that go into building a home are more expensive, dramatically more expensive. They went up by double digits, where overall inflation may have gone up to somewhere between 8% and 12%. Construction materials went up more like 20% to 25%.

[00:06:16] Some of those costs, those inflation numbers are down in 2023, but they’re not down below, they’re just not escalating as fast. So that means that the economy has still a lot of catching up to do from the pandemic, and those costs continue to impact what insurers have to pay out.

[00:06:33] Now consider what happens when 4,000 homes are lost in a single event. Consider what happens when there are simultaneously hurricanes out east, hurricanes in the Gulf of Mexico, and unusually a hurricane that comes up through California and it becomes a rainstorm that does damage in the billions of dollars across Utah, California, and southern Idaho.

[00:06:59] These are massive storm events and they’re happening more often. Record numbers like $100 billion in insurance losses, insurance payouts for natural disasters. Already this year (October 30, 2023), a record of $50 billion for what are called convective storms. That’s one kind of peril. Convective storms are when moist air comes up from the earth and it manifests itself in any number of different ways, from hurricanes to hailstorms to tornadoes. All those things are happening more frequently, they’re happening in more places, and they’re causing a lot more damage across the country. So all of those things are adding up for much higher costs for insurers.

[00:07:36] And then of course, there are the other costs that are always a part of the insurance process, like liability claims against insurers and having to go to court more often and ‘nuclear verdicts’ and all that sort of thing. Those things are kind of already built into the rating process, but then you add on top of that these massive natural disasters and insurers are struggling. They’re paying out massive amounts of their reserves.

[00:07:59] So in the good times when people wonder about insurance company profits and whether CEOs are paid too much, and whether insurers keep too much money in their bank accounts instead of paying it out in claims, the fact is, that insurers always have to pay out claims or they get sued or they get in trouble with TK (Keen, administrator of the Oregon Division of Financial Regulation).

[00:08:15] But also they have to have reserves because their times when the amount of money they’re taking in is less than the amount of money they’re paying out in claims, and that’s called the combined ratio. And a lot of insurers right now are upside down with their combined ratio. They’re taking in a dollar and they’re paying out $1.40.

[00:08:33] Insurers cannot afford to keep that up for very long. Those reserves dip down low. That changes their A.M. Best rating. It’s not good for the companies and it’s bad for policyholders because you don’t want your company to run out of money before they’ve paid all the claims.

[00:08:49] So what are insurance companies do? They get reinsurance. That’s insurance for insurance companies. They pay a lot of money for those insurance policies. Those policies kick in after a certain amount of money is paid by the insurance company to their policyholders and it backfills the surplus or helps them pay out claims so that they don’t go under, when things are really difficult.

[00:09:10] That insurance is getting harder to get for insurance companies and it’s getting more expensive, again, leading to why does insurance cost so much? That’s one of the reasons why in this current environment we’re seeing that.

[00:09:22] TK (Keen)’s boss said this at a Salem City Club meeting a couple of weeks ago. The insurance department here and insurance departments across the West are keenly aware of what’s happening out there in the marketplace. They’re doing their best to keep up with insurance filings, rate filings. It’s important for you to know that insurance companies can’t just raise your rates. They have to have their rating plans filed and approved by the insurance department in this state and Washington state, most other states, they have to do that. And they do that here.

[00:09:50] So they have to be actuarially justified. They can’t just make it up. Thing is, though, that an insurance company might file a statewide rate of 5% increase. That means some people are going to get a 30% increase or a 50% increase, and some people are going to see no increase at all. They’re trying to figure out how best to judge the risk. And that’s where we come into things like wildfire risk scores, company algorithms to help determine what their risk is for how many policies they’ve written, underwritten, and what they’d have to pay out in the event of a large-scale disaster.

[00:10:22] So that’s kind of a snapshot of a look at the insurance market, and I’m going to turn it over to TK.

[00:10:32] TK Keen (Division of Financial Regulation, administrator): So let’s dive right in and talk about the buildup to the 2020 Labor Day wildfires and what was on the mind of Division of Financial Regulation and governor’s office and legislators before we got there.

[00:10:46] There was a Governor’s Wildfire Council put together to start to think through what we needed to do as a state and the investments we needed to make in order to ensure that we were as protected as we possibly could be as it relates to wildfires.

[00:11:03] None of this, in terms of what happened in 2020, I would imagine, was on the minds of most people as they were serving in 2018 and 2019 and putting this work together. The flavor of it for Division of Financial Regulation was really centered on what incentives could insurance companies provide or the state provide to consumers to create defensible space in their homes so they could be more eligible for homeowner’s insurance or building hardening or any number of steps that we could provide.

[00:11:34] And unfortunately with 2020, just a confluence of events that was really, really difficult for everyone. It just put the conversation in a completely different context.

[00:11:46] And going back to those times, we had the ability to put in place an emergency order, but our emergency order authority is fairly limited in scope. We can do things like extend the amount of time that it takes consumers to make a premium payment or fulfill other obligations. We can put a pause on cancellations or nonrenewals during an emergency.

[00:12:09] We can give people more time to provide information about their claims, but that’s pretty much the entirety of it. And so the bulletins were in support of those emergency orders and providing details around which areas were being impacted and that relief was being granted. We did put forward also some guidance bulletins on expectations that we had for insurance companies during this period of time.

[00:12:33] So we might not have had legal authority to go in and order them to take a specific action like, for example, to provide three years to rebuild versus one year, which was in the insurance contract. But we could publicly put it forward that that was our expectation and start to create those expectations publicly, which was helpful.

[00:12:54] Most insurance contracts and homeowners have a one-year rebuild period. That was going to be wholly insufficient, based on what we saw in 2020. And so we sat down with Kenton (Brine) and we sat down with a lot of insurance companies and asked that they commit to providing two years to rebuild, three years.

[00:13:11] Many companies said, you know, ‘We’ll give the consumer as much time as they need,’ which was huge because people were feeling not only the pressure to rebuild quickly, in the midst of a pandemic and a labor shortage, but also, the stress of the event itself and the trauma that goes along with just trying to organize your life after you’ve had your entire house and all of your belongings wiped out. It’s just unfathomable in terms of a disaster.

[00:13:37] We negotiated those agreements and put those on our website and let consumers know that, you know, ‘Hey, if you are in need of more time to rebuild, this is what we’ve negotiated out with the insurance companies.’

[00:13:49] And so in addition to that, being the consumer protection arm for the state in insurance, we were out in the field actually in the days after the 2020 fires and years preceding that. And currently we have an outreach team that’s dedicated to go out into the field and help consumers file claims, give them information about their insurance policies, to the best that we can do.

[00:14:11] We’re a bit like the referee in the game and so we can explain generalities, we can sit down with the consumer one-on-one and look over their insurance contract and offer them the opportunity to file a formal consumer complaint. But, you know, the insurance companies themselves, who they have that contract with, also has a role here. And so that’s just one aspect of what we do is field operations.

[00:14:35] I would also add here, in addition to the consent agreement and the work in the field, other tools that we used in the midst of were really looking at data calls and pulling back information. We cannot get information unfortunately in real time during a disaster. It does take some time for data to come to the insurance company and then for us to go retrieve it, but we have that ability.

[00:14:59] In brief, we also conduct market conduct examinations and desk audits so that we can ensure consumers overall are getting the benefits that they’re entitled to.

[00:15:10] And no doubt climate change is greatly impacting the availability and affordability of insurance in Oregon. And people who bought thinking they were safe and building in a spot that wouldn’t be affected by significant drought or wildfire risk 25 years ago, are now finding out that, as climate change has progressed, that they are living in spots that are greatly impacted.

[00:15:34] So that’s one component of our involvement. We serve on a number of national committees looking at this as well as working within the state on what could we do from a policy perspective around the climate change that we’re all seeing, touching on that insurance perspective.

[00:15:50] And finally, we are really focused on availability and affordability of coverage at this point in time. We know people are continuing to see cancellations, nonrenewals, significant rate increases. To that end, we have a market of last resort. It’s called the Oregon Fair Plan. It’s really meant as a temporary tool to get people coverage in a pinch. And it’s not particularly affordable, but it does provide a necessary bare bones coverage and we’ve increased the limits around the Fair Plan to provide people with more coverage.

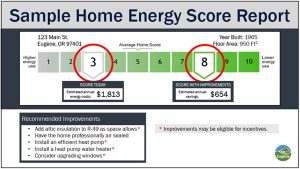

[00:16:20] But I would say on the whole, big picture issues, just the amount of underinsurance that goes on unfortunately in the state, it’s easy to underensure yourself. And unless you have a robust check every year, it’s a challenge to keep up with it in a lot of respects. So a lot of our education time is spent on making sure people are insuring to the proper levels and how they can do those checks themselves.

[00:16:43] John Q: They were asked if industry can track the number of people uninsured or underinsured.

[00:16:50] Kenton Brine (NW Insurance Council): Well, obviously we can’t track what people don’t buy, right? So the uninsured problem I think is, we can assume is, relatively small but it’s huge to the people who are impacted by it, obviously. But statistically, it’s probably not a huge percentage of people. However, underinsured, like there have been, I believe, national studies done recently that suggests that like one in five homes are underinsured by as much as 30%.

[00:17:21] So again, the lesson here is, insurance isn’t a tremendously exciting topic for a lot of people. I like it, but it’s not for everyone. And once you get it, you want to pay as little for it and get as much covered as you can. And you just want to assume that all the things that you think you go wrong are going to be fully covered because you see the ads on TV and everybody’s happy.

[00:17:43] Well, insurance is a complicated contract of service provided by a company to you. And if you don’t know what’s in your policy, the time to find out is not when you file the claim. And the time to find out you’re underinsured is not when your whole house burns down. So as much of a homework assignment as it is, every news release we put out, we say, ‘Go talk to your insurance agent.’ You should do that once a year, and you should have a thorough understanding and ask a lot of questions about what’s in your insurance policy.

[00:18:11] We have some tips and guidelines on our website too for what kinds of questions you should ask, but you should know if your homeowners policy is ‘actual cash value’ or ‘replacement cost coverage.’ Actual cash value policies do increase a little bit with inflation, but they’re not going to keep up with a dramatic increase in building costs like we’ve seen in Oregon and elsewhere across the country in recent years.

[00:18:32] TK Keen (Department of Financial Regulation): What I would add is, House Bill 3272 did deal with this in terms of providing us a cost estimate for the value of your home at renewal. And so that’s an option available for all consumers should be getting that.

[00:18:45] But beyond that, what Kenton shared is spot on and is very much in your interest to go home tonight and look at your insurance policy and make sure you understand the ins and outs of it. And if you don’t, then take the time with your agent to sort that out, because underinsurance is just a massive problem given the cost that we’ve seen increase—in just plain inflation, in labor across the board, cost of building goods. So that is just something that every should have on their radar.

[00:19:16] Complete uninsurance, I agree with Kenton, that’s probably a small problem, but it’s a costly problem. There are a few people who just can’t get insurance. There may be a spot where their mortgage is already paid off and they’ve just decided that they’re going to forgo either because of cost or unavailability to have insurance and that’s not something we can easily measure.

[00:19:39] We’re getting better data all the time from the insurance companies in terms of actual coverage and who has coverage and the value of claims cumulatively, but capturing underinsurance and uninsurance is a real issue.

[00:19:52] John Q: As we head into another wildfire season, experts from industry and government suggest getting insurance, or, if you’re already insured, reviewing your policy. They recommend double-checking what’s covered, and how much the insurance company will pay. Learn more at the Division of Financial Regulation website, where you can read other peoples’ questions, or send in questions by email.