Climate change and your insurance bill

3 min read

by Marty Wilde

Insurance companies make easy villains. Property insurers take premiums for decades, then, due to the vagaries of trust principles and a clear profit motive, they do their best not to pay when tragedy strikes.

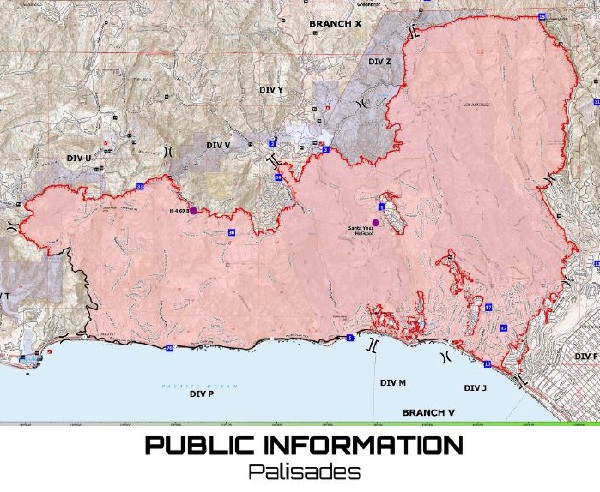

Long before the recent LA fires, property insurers denied renewals of properties they deemed to be at high risk, including State Farm’s decision last year to non-renew 69% of their policies in the recently burned Pacific Palisades. This left many homeowners forced to buy from California’s expensive insurer of last resort plan.

These insurance decisions weren’t born of cruelty or even avarice, but rather from a clearer view of how climate change will increase risks for homeowners.

All insurance arrangements act as a subsidy from low risk people to high risk people, with the agent taking a cut. When these risks are random, as is largely the case for health problems, we are less likely to object to carrying others. After all, we could end up in their shoes. But when people embrace preventable risks, we resent paying for their risk-taking.

To keep low risk rates low and protect profits, insurers have an incentive to drop high risk policies. Anyone who has lost their auto insurer after getting too many tickets has experienced this.

Alternatively, insurers can raise rates, although many states require approval for rate increases and often require insurers to limit these increases to reflect historical incident rates.

Further, states often offer expensive policies in high risk insurance pools for people who cannot buy commercial insurance, as a way to make sure at least some form of property insurance is available.

Those insured fight hard to avoid assignment to high risk pools that have rates reflecting the real cost of insuring properties, rather than the subsidized rates they are used to.

We have seen this recently in Oregon, where people living in high risk areas are resisting the Oregon Department of Forestry’s risk-mapping project, because they are afraid that they will lose their subsidy from lower risk properties. Indeed, resistance reached such a peak that the Oregon Legislature prohibited using ODF’s maps to set insurance rates. Insurers promptly drew their own maps.

Superficially, it does seem strange that a wooded property in Eugene would have significantly lower rates than a similar wooded property out in the county. However, taking a closer look, people who live in the city pay substantially greater taxes to support more robust fire departments. Put another way, they’re already paying the increased cost, just through a different mechanism.

The challenge we all face is from relying on historical fire incidence rates to determine the cost of our insurance, because climate change is increasing fire risks.

California recently amended its insurance laws to allow insurers to project future costs, and thus future rates, based on climate modeling. This did not please Allstate’s California insureds, who had been accustomed to a de facto 7% cap on insurance rate increases and who saw a 34% increase last year. You can be sure California’s elected insurance commissioner is feeling nervous about his political future.

California also saw the dollar value of property insured by its high risk plan increase 61% last year. Last year, in Pacific Palisades, the high risk plan saw an 85% increase in the number of policies.

There is no free lunch. While states can squeeze insurers to reduce their cut as the middleman between policy rate payments and payouts, climate change will continue to force greater payouts, causing higher insurance rates.

We can reduce those risks through more thoughtful building codes, fire protection planning, and defensible space. However, fire risk will remain elevated until we address the carbon pollution that drives climate change and the fires it causes.

The fault lies not in our insurers, but in our failure to address climate change, the main driver of the risks they insure against.

Marty Wilde represented central Lane and Linn counties in the Oregon legislature. For more of his Letters From a Recovering Politician, subscribe at https://martywilde.substack.com/subscribe.