Broad coalition urges pause on fossil fuel investments

10 min read

Curtis Blankinship (KEPW News): The Pause Act will enact a five-year moratorium on new PERS (or Public Employees Retirement System) investments in private fossil fuel funds.

For the past 50 years, the finance sector has dangerously rewritten the rules of the global economy, including here in Oregon. We have seen wealth extracted from our communities while our greenhouse emissions skyrocket.

At the leading edge of this transformation has been the aggressive expansion of the private investment sector, generally referred to as private equity, which has over $1 trillion in fossil fuel investments. Beth Genly and Sue Palmiter discuss the progress Divest Oregon has made defunding fossil fuel use.

[00:00:46] Beth Genly (Divest Oregon): I’m Beth Genly, a volunteer with Divest Oregon. As a PERS contributor and beneficiary, I’m interested both in seeing that PERS returns are healthy and in seeing that our Oregon economy is protected from climate change.

[00:01:01] Thank you all for your support of the 2024 COAL Act, which passed last year with support of all the Democrats in the legislature. It focused on one provision in the Treasury net zero plan and divestment from COAL is now starting to happen.

[00:01:15] This session, we’re focusing on another critically important promise in the treasurer’s net zero plan, and that promise is supported by the Pause Act, which is SB 681, and you can find the one-pager and more information on divestoregon.org.

[00:01:33] So the Pause Act is sponsored by many senators and representatives, especially Sen. Golden, who is our chief sponsor, assisted by Sen. Pham, Sen. Taylor, Rep. Gamba, and others. And the Pause Act is very simple.

[00:01:51] There’s a five-year moratorium on new private investments in fossil fuels. It doesn’t ask them to divest from the existing ones, but it puts a moratorium on those new ones going forward, and let the Treasury to report on actions to reduce climate risk and include just transition principles.

[00:02:12] So that’s it, just those two things. So private investments in Oregon are a big problem for the Treasury now. They used to be an investment with high returns, but not anymore. The private equity market is saturated and returns are down, and each commitment to a private fund locks in hundreds of millions of dollars for a decade. And in private investments, the fund manager, not anyone in the Treasury, controls the fund.

[00:02:39] Private funds are generally known as private equity but there’s a whole list of other ways to call it in our Treasury. And because of the various kinds, 60% of the $97 billion PERS fund is largely hidden from the public.

And because so much of PERS is locked into these nonliquid decade-long investments, the Treasury is having trouble coming up with cash for beneficiary payouts. Sixty percent of the pension fund is a really high number.

[00:03:13] The Pause Act specifically targets those private investments that are primarily invested in fossil fuels per the treasurer’s net zero plan.

[00:03:24] Sue Palmiter: Thanks, Beth. My name’s Sue Palmiter and I am the co-lead of the Divest Oregon campaign along with Jenifer Schramm. We’re a coalition of a hundred-some organizations around the state, all volunteer, working towards getting a cleaner Treasury investment. We wanted to talk to you about some specific numbers that we have learned about in the last three years while we have been working on this campaign.

[00:03:52] One is that the Oregon Treasury is kind of out of balance compared to their peers. Compared to the California public retirement systems and New York City, New York State retirement systems, pension systems, Oregon has a predominance in private investments, as Beth mentioned. And as of June 2024, they were at 16% with public equity. Those are stock market funds that you can trade easily in and out.

[00:04:28] Whereas their private equity was almost double or even triple some of their peers and these other asset classes that Beth mentioned, real estate, real assets, opportunity to diversify, those are the ones that all add up to about 60% of the portfolio, which is just out of balance compared to their peers.

Note: She referenced an article published Jan. 23, 2025. From Divest Oregon, Sue Palmiter:

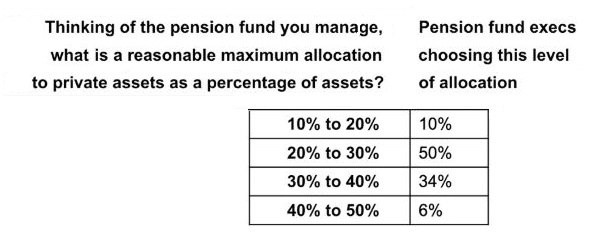

[00:04:54] Sue Palmiter (Divest Oregon): In fact, there was just a recent article in Chief Investment Officer about a week ago that asked a lot of pension managers around the country what was considered a private asset allocation that was reasonable. And the majority said in the 20% to 40% range seemed reasonable and we’re at 60%. So Oregon is way off the charts in taking risk with private investments.

[00:05:24] This is another way to look at it: Until about 2010 or so, we were at the 17% to 20% of the portfolio, and then there’s just been a steady incline over the last 15 years or so that just has us now at this 60% ratio. And what’s that meant is that there’s a lot less available for public equity, which are those public markets where there’s been just a huge bull market, huge returns coming from that market.

[00:05:54] And because they’re so overallocated, more than what the Oregon Investment Council has set as their limits, they are not getting the returns that one would hope. This is just another way to look at it over that time period, how which has grown incredibly in the last 10 years especially.

[00:06:15] And if we look at two of the private investments that we know about with fossil fuels, which is the focus for the Pause Act, these are investments that were made just recently since Treasury announced his net zero plan.

[00:06:33] One was in December of 2022 with a big LNG terminal that’s being built or trying to be built in the Rio Grande area of Texas, in the Gulf, a $350 million commitment that the Treasury has made towards that terminal, and it’s been opposed by the Indigenous folks whose land it would be built on, it’s been opposed by European and American insurers who don’t think it’s a good investment. And yet the Oregon treasury made that investment.

[00:07:03] And then just about six months ago, another LNG expansion project in British Columbia had about $200 million. So you can see these are huge investments, hundreds of millions of dollars in new infrastructure. And this is what we really want to see stopped going forward.

[00:07:22] Again, as Beth mentioned, it isn’t that we’re asking them to sell these now. They’ve made these investments. They would take a loss, so we aren’t asking for that. We’re asking for no new investments in these types of enterprises.

[00:07:37] And finally, you might hear from some that the Treasury is doing well with private investments, so they need to continue because those returns are good. But just in the last week, the Oregon Investment Council sets a policy that says private investments are risky and they’re illiquid.

[00:07:56] That means they can’t sell them quickly like they could with a stock. They have to hold on to them for 10 to 12 years and because of that risk and that illiquidity, they say that the return should be at at least the Russell 3000, which is a benchmark of stocks, of publicly traded stocks, plus about 3%, because of the risk they’re taking and the illiquid nature of the investments, that they should be doing that much better.

[00:08:25] From the Treasury in their recent Jan. 22 meeting, they are way below those benchmarks. So here you’re seeing the benchmark of what it should have been for the past year, three years, five years, 10 years, and they’ve been way below that benchmark. So they aren’t performing for Oregon and they’re not performing. And those fossil fuel pieces, we want to stop going forward.

[00:08:56] Olive (Divest Oregon): My name is Olive. I work on the legislative team with Divest Oregon. What brings me here is just a lot of concern for the future, but also recognition that climate change is here now and we need to take some serious strategic action, which I think divestment from fossil fuels does.

[00:09:15] Sue and Beth talked a little bit about the issues with private equity funds themselves. I’m going to talk a little bit more about the climate side of this bill.

[00:09:25] So just to start right off, the Pause Act would protect PERS from more financial risk. So fossil fuels create climate risk and climate risk creates economic risk. And so the Pause Act could be adding another layer of protection to this important pool of money. And the Pause Act also codifies a very important portion of the treasurer’s ‘Pathway to Net Zero’ plan that actually several large Oregon labor unions do support.

[00:09:55] This moratorium would give the treasurer time to transition to less risky investments while being able to rebalance the portfolio to come in line with Oregon Investment Council policies. So the Pause Act can really support the treasurer here in implementing this important part of the plan and we can stop digging this hole deeper.

[00:10:16] And then the other important part of the Pause Act is the aspect of transparency. The treasurer must report on its actions towards a just climate transition and on addressing the systemic risk to the funds due to climate change. So transparency is another very important part of this bill.

[00:10:36] Pause Act supporters, many of these names are either labor unions, faith groups, youth groups, or climate and racial justice groups. Okay, and then we’ve already talked about this, but just to drive this point home, the Pause Act or Senate Bill 681 is very simple. It pretty much has two parts.

[00:10:57] First, it’s a five-year moratorium on private investments where fossil fuels are 10% or more of the private fund. And the other part is requiring reporting on actions to reduce risk and include just transition principles.

[00:11:12] The Oregon Legislature has actually already said it has a 100% clean energy target. On top of that, the Treasury’s net zero plan does acknowledge the climate change risk to the portfolio and says that they will end private market funds that are primarily fossil-fuel-based.

[00:11:29] So the 2025 Pause Act really isn’t stating anything new. It’s really just supporting these already-existing plans and adding another layer of legislative enforcement mechanism so we can actually meet these goals. And if you have any questions or would like to see the one-pager, go to DivestOregon.org.

[00:11:48] Curtis Blankinship (KEPW News): For KEPW News, I’m Curtis Blankinship.

A spokesperson for the Oregon Treasurer said use of the 60% statistic may be misleading to listeners.

Spokesperson Eric Engelson said the percentage allocated to private equity is limited. According to an online report, the current investment of just over $25 billion represents 26.5% of the fund, a bit closer to the 27.5% limit than to the 20% target.

Eric Engelson wrote in a March 6 email message: “Treasury manages the Oregon Public Employees Retirement Fund (OPERF) to deliver sustainable, risk-adjusted returns to help support public employees in retirement now and in the future. All of our decisions regarding investments are guided by our fiduciary duty to pension beneficiaries. Treasury shares Investment information and performance data on our agency website within the ‘Performance and Holdings’ webpage at: https://www.oregon.gov/treasury/invested-for-oregon/pages/performance-holdings.aspx

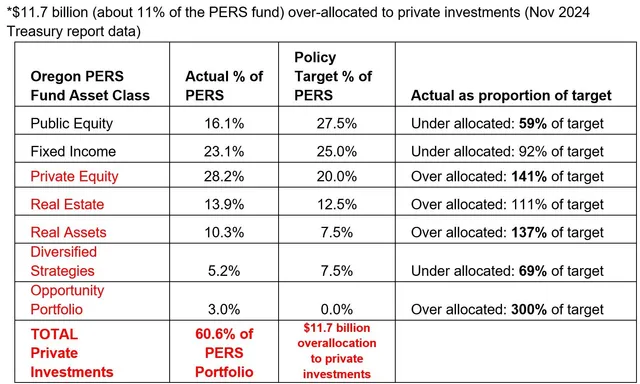

“Additionally, I’d like to provide some clarifications around the Divest Oregon statement you shared, which we feel may be misleading to listeners. Specifically with regards to ‘PERS fund is 60% invested in private investments’ and the private investments being ‘way over limit set by the Oregon Investment Council.’

“Regarding the ‘PERS fund is 60% invested in private investments,’ we interpret that statement to misrepresent our portfolio’s current asset structure. Combining a number of separate portfolio asset classes into one group, which may be inclusive of all or portions of our Private Equity, Real Estate, Real Assets, and Opportunity asset classes. If that assumption is correct, those holdings are still less than the 60% they state. A full breakdown of our asset class allocations is available in this report, updated January 2025.

“Their claim that we are “way over limit” is not accurate. As reflected in our most recent asset allocation report, these holdings are within the limits set by the Oregon Investment Council, available on page 15 of the Council’s policy statement. A quick breakdown is provided below:

- Private Equity: current 26.5%; limit 27.5%

- Real Estate: current 14.1%; limit 17.5%

- Real Assets: current 10.6%; limit 10.0%

- Opportunity: current 3.0%; limit 5.0%

- Total: current 54.2%; limit 60%

“As Treasury is committed to accurate and transparent reporting practices, we believe misleading and inaccurate statements like this regarding government activities can be harmful to the public. We greatly appreciate you reaching out and for your consideration of making any corrective notations to Divest’s statements on your website or to your listeners.”

Andrew Bogrand of Divest Oregon said the initial public service announcement uses data from November 2024:

In an email message, he wrote: “In November, Oregon Treasury was over the limits set by the Oregon Investment Council (and these are the max limits, not the middle-range targets). This is an accurate statement and was not intended to mislead the public nor undermine faith in the Oregon Treasury. It is worth noting that a 60% max allocation toward private investments is high in comparison to other public pension funds in the U.S.

“We are similarly committed to transparency and provide Oregon Treasury officials with an opportunity to comment on all of our reporting and press statements. To my knowledge, Oregon Treasury leadership has not pushed back on these figures. While we don’t always agree, we have a had positive engagement with the Treasury for multiple years and have a deep respect for their staff and work.”