Policy for the People: Though well-meaning, Measure 118 has unintended consequences

5 min read

Volunteer presenter: KEPW will start sharing programs produced by the Oregon Center for Public Policy and community radio station KMUZ (in the Mill Creek watershed).

Juan Carlos Ordóñez: Welcome to Policy for the People, a show that explores the public policies that can lift up all Oregonians. This show is a collaboration between KMUZ Radio and the Oregon Center for Public Policy. I am your host, Juan Carlos Ordóñez.

Volunteer presenter: Here’s a sample from one of their programs, about one ballot measure that’s getting a lot of attention in the upcoming Nov. 5 election.

[00:00:33] Juan Carlos Ordóñez: The measure, known as the Oregon Rebate, would make it so that each year, every resident of Oregon, every adult and child residing in our state, gets a rebate, a payment, from the state.

[00:00:46] The amount of the rebates would vary every year, but it could initially be around $1,600 per person.

[00:00:54] To pay for the rebates, the measure would institute one of the biggest changes to Oregon’s tax system in decades, a huge increase to the Oregon corporate minimum tax.

[00:01:04] From the Oregon Center for Public Policy, the Center’s Deputy Director Daniel Hauser. For more than seven years, he has led OCPP’s research on tax policy.

[00:01:15] Daniel, this November, Oregonians are going to be voting on Measure 118. Can you walk us through the basics of this ballot measure? What would Measure 118 do if it were enacted?

[00:01:29] Daniel Hauser: If it was passed by voters in the November 2024 election, it would create what the proponents call the Oregon People’s Rebate, a rebate issued each year to every Oregon resident.

[00:01:40] Everyone, every family member would get the same amount, right, which would be an equal share of the revenues raised by a new tax that’s also included in the measure. The money raised from this tax increase would be sent equally, as I mentioned, to every Oregonian, as long as they were in the state over a certain number of days, and they met really minimal eligibility requirements.

[00:01:59] Juan Carlos Ordóñez: So how big would these rebates be?

[00:02:02] Daniel Hauser: Well, that’ll depend entirely on how much tax revenue is raised and how many Oregonians are eligible. There are new estimates that the Oregon People’s Rebate, Measure 118, would raise enough money to give each Oregonian about $1,600.

[00:02:17] So that’s $1,600 per Oregon resident. But again, that amount will vary heavily year to year. It won’t be the same every year as more and less Oregonians are eligible, and as more and less tax revenue gets brought in by the measure.

[00:02:32] Juan Carlos Ordóñez: So, is this a good idea? What’s your bottom line assessment of Measure 118?

[00:02:38] Daniel Hauser: Big corporations should pay more in taxes, right? In 2017, Congress passed an enormous package of tax cuts. And as part of that, they cut the corporate tax rate and they created all sorts of new, um, opportunities for corporations to avoid paying their fair share.

[00:02:55] U.S. corporations parked about 45% of their profits in tax havens where they only had less than 2% of their employees, right? So 45% of the profits is marked up in these, in this less than 2% of their employees are located. So a profit sitting in Singapore is a profit not properly taxed here in Oregon.

[00:03:14] So corporations, they’ve had their rates cut. They’ve had plenty of opportunities to shield their profits from being taxed at all. And it’s really clear that corporations should pay more in taxes in Oregon and nationally.

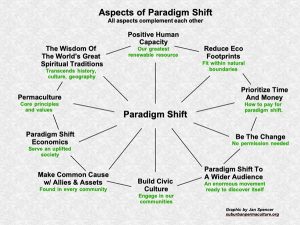

[00:03:25] And we also know that giving cash to struggling families is a good policy. It’s an effective way to make families more economically secure. Dozens of studies on cash programs from guaranteed income pilots and communities across the nation, including here in Oregon, to research on the impacts of cash tax refunds, like the earned income tax credit and the child tax credit. And they all point to the same general truth.

[00:03:47] If you give a family money to spend on their priorities, they spend it on meeting their basic needs, right? A safe room to sleep in, warm food for dinner, the ability to get around their community if they get to school or work. It also sets a family up to invest in starting a business, right? Buying a home or getting a degree.

[00:04:04] It’s a catalyst for further economic stability. And importantly, children who grew up in economically secure homes are more likely to succeed as adults to really thrive. Fewer crimes, more education, more income, longer, healthier lives. And all of this, to be clear, has really immense benefits to the state and to society as a whole.

[00:04:24] So when we start from this perspective, right, cash is good, giving struggling families money is a good thing, taxing corporations is good and needed. It’s clear that Measure 118 gets some things right.

[00:04:35] But unfortunately, Measure 118 is poorly designed, and it triggers an array of damaging, likely unintended consequences that make it really a measure that is not a good idea— the measure would reduce the funds available for Oregon schools, childcare, healthcare, and other essential services that we pay for through the Oregon General Fund.

[00:04:56] Juan Carlos Ordóñez: Money that otherwise would have gone into the state budget to pay for K-12 schools, health care, and so on, some of that money will instead go to help pay for these tax rebates because of the way the measure is written. Is that a general summation of it?

[00:05:14] Daniel Hauser: That’s right. I mean, the general fund right now gets more than $1 billion from the profits-based tax. And that’s projected to sustain and even increase up to $1.5 billion per year. If Measure 118 passes, a significant share of that more than $1 billion per year would, instead of going into the general fund, would now go towards the rebates.

[00:05:37] Volunteer presenter: That’s a sample from the new KEPW program, Policy for the People. For more, listen to the full program simulcast at KEPW.org, or visit the Oregon Center for Public Policy website at OCPP.org, with community radio KMUZ.org.