Council may revisit gas tax, annexation to boost funds lost during pandemic

6 min read

With several city funds down during the pandemic, the City Council discussed new sources of revenue.

This week, the City Council heard the latest on the budget.

[00:00:03] Twylla Miller: I’m Twylla Miller, the City’s finance director. We often hear how well the economy is doing at the national or the state level, however, the City doesn’t directly benefit from many of this good news and these upswings in the economy. If the job market increases, income tax revenues may be increased for the state, but we don’t receive those at the city. Also, unlike some other local governments elsewhere, the City does not receive sales tax, so increases to consumer spending do not increase the tax revenue for the City. And despite the recent uptake in housing values, property taxes in Oregon have constitutional limitations. So the takeaway here really is that each government has a different set of revenues and provides a different set of services.

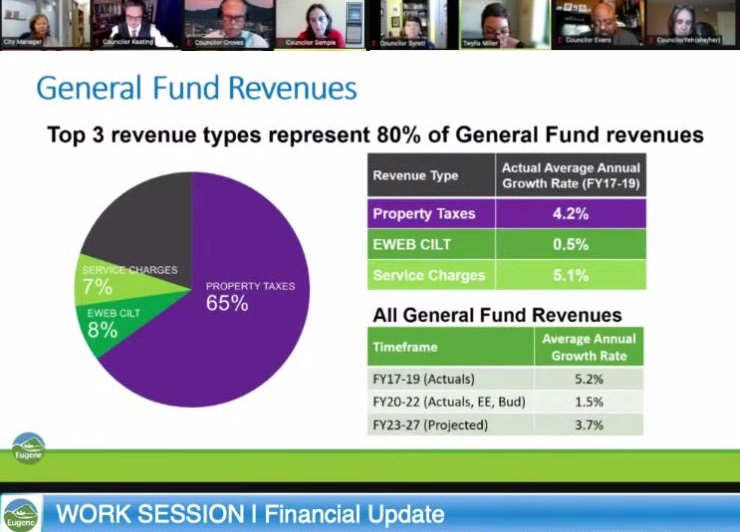

As you’ll recall, the general fund represents discretionary fundings for the City that aren’t required to be used for a specific purpose. So they’re really our most flexible funds, with the top three revenue types accounting for 80% of total revenues, with property taxes representing the largest share at 65%. Contribution In Lieu of Tax, or CILT, revenue received from EWEB is driven by the price of electricity, and then there are service charges, which include revenues from recreation, library, spay and neuter clinic, police and fire services, and many others. But unlike property taxes or CILT where we have limited or no control over the amount of revenue we receive, we can influence this revenue category through the fees you charge for City services.

Thank you for supporting

local citizen journalism

[00:01:29] Councilor Matt Keating: I find the funding considerations slide intriguing and was poking around at ODOT’s (Oregon Department of Transportation’s) fuel tax rate web website webpage, and was examining the fuel tax rates. In addition to the state of Oregon’s tax rate of 36 cents a gallon and the federal government’s tax rate of, I believe it’s 18.40 cents per gallon, each municipality can charge their own rates and the city of Portland charges 10 cents per gallon, and the city of Coburg 6 cents per gallon, and the city of Eugene at 5 cents per gallon. When was the last time the municipality adjusted our local gasoline fuel tax rates here in Eugene?

[00:02:17] Councilor Mike Clark: It was late ’08 or it was early ’09.

[00:02:20] Councilor Matt Keating: Yeah. Wow. That long ago. Yeah. That’s fascinating. Twylla, you mentioned that, the dip in the parking revenue during the pandemic. Normally I’d be driving 12,000 miles a year, around the national average. And if, I’d be shocked if I put on 2,000 miles, if that, last year. So I think it is, especially if Councilor Clark, if your memory is accurate, which it often is. And if it’s really, it was really late ’09. Yeah. I think it’s worth exploring just at the very least to be on par with our neighbors to the north, the city of Coburg, a much smaller municipality and jet fuel for that matter. Whereas consumers who are sharing the road are spending 36 cents state, 5 cents locally, 10 cents Portland, the jet fuel consumption is around 3 cents per gallon. I think it’s worth exploring jet fuel as well.

[00:03:14] Councilor Mike Clark: I’m really glad to hear my colleague bring up that question. In our climate goal measurements, we rarely talk about the tons and tons and tons of fuel that is burned with our airport. And I think that’s a very interesting discussion that I welcome.

The biggest source of our city’s revenue is property tax. Right? I wonder why it is we never talk about strategies for increasing the amount of property tax revenue we receive, aside from the rate restrictions that exist in state law, because there are policy decisions we can make that would radically increase the amount of money we receive in property taxes. My rough guesstimates of what I’ve seen, a piece of bare land almost triples in value as soon as you build a house on it, right. So do the taxes at that point. City of Beaverton, with half our population, has set a goal this next year to build 500 new houses. We’ll barely get over 200 new houses built this year, single family. If you go back 12 years, we were building eight or 900 new houses and we desperately need them. Anything in my opinion that we can do to be building new single family homes both helps with the housing shortage, the price of housing, the problem of homelessness, and increases our tax revenue. I can’t think of a more important goal than what do we need to do to be more helpful, to see more homes built.

If we looked at another pet issue of mine, there are 22,000 people who live in River Road, in Santa Clara, and they’re not parts of the city. If we were to annex as few as 500 of those houses, and it’s a couple of million a year in new taxes, and we can do that in a way where it makes sense to them to do it voluntarily. I’m not talking about forced annexation. I don’t think I’d ever agree with that. But we have the capacity to offer it to them as something they could do and participate fully in the city and increase our tax base.

Those two things are things I really hope we begin to talk more about because I think we’re going to face budget issues to the debate over the next, at least two or three years. And there are simple policy decisions that can help us increase our tax base.

[00:05:37] Councilor Claire Syrett: My colleagues’ questions and comments triggered some questions for me. So in terms of the gas tax on automobiles, we can only use those on roads, right? They’re not going to fill our general fund gap. So I think that’s important for us to recall. It might help us with the bond, and maybe we could reduce the bond if we raised revenues elsewhere. And then I suspect the aviation fuel tax has to also be used for things at the airport, since every other revenue we raised at the airport has to be used at the airport.

And then in terms of what Councilor Clark was speaking to the fact is that multifamily housing and higher-rise, denser housing would have a much greater impact on our revenues relative to the cost of providing services to those buildings. And actually single-family homes, like the one I live in, become a net loss, in terms of their contribution to the tax base versus the cost of providing services to them. And we had a really compelling presentation on this a few years ago, in terms of net gains of tax revenue from high rise buildings versus single family homes, or also commercial buildings like Walmart, which take up a ton of space and don’t really add value and cost a lot in terms of our need to send streets and roads and other services out there versus commercial buildings that go up.

So sticking to our commitment to build more densely and vertically, we’ll actually do what Councilor Clark is saying, increase property value of those properties, and then not be as expensive to provide service to, as if we were building just single-family homes or one-story commercial.

[00:07:30] Councilor Mike Clark: Just real quickly, I went and attended that private presentation that that consultant put forward. In my opinion, it was based on some incredibly faulty assumptions. And it was pretty easy to knock down argumentatively as it applies to our city from that outside consultant, and I’d be happy to debate that anytime. Not today, obviously, but either way, the larger point I was trying to make was making more of the land we have and building more homes for people. However we do it obviously increases the tax base and it increases our ability to respond to the demand for services we have, as well as then voluntary annexation. So I’m hoping that this council does more discussions around that, and I welcome the debate and discussion around that consultant’s presentation. But those are the ways we grow our tax base, which is the most effective way we can see revenues increase and meet the demand for services.

[00:08:28] John Q: The City Council considers new sources of revenue.