Divest Oregon has questions; the Oregon Treasury responds

4 min read

Presenter: Here’s a message from Divest Oregon, a statewide grassroots coalition that includes Active Bethel Community, Beyond Toxics, Breach Collective, Climate Action Cottage Grove, Coast Range Association, Community Rights Lane County, Eugene DSA, Eugene Raging Grannies, Eugene Springfield NAACP, 350 Eugene, and many other groups across Oregon.

Divest Oregon: Private equity and the Oregon Pension Fund.

We’ve heard a lot about private equity lately and the Oregon State Treasury has our pension fund heavily invested in it, but what exactly is it and why does it matter?

[00:00:36] Well, when the Oregon Treasury invests in private equity, your funds go into investment that is kept secret. Since they’re not publicly traded, they focus on their own profit.

[00:00:45] So what do they do? They typically buy businesses with investors’ money, load up the businesses with debt, then lay off employees and cut services, plus charge the investors high fees. They make money.

[00:00:56] But the businesses? They often go bankrupt, but first services get worse, workers are out of work, often replaced by non-union workers. That’s union busting.

[00:01:05] What’s more, they are known to invest heavily, and I mean heavily, in fossil fuel infrastructure like oil pipelines and offshore oil rigs. They pour billions of dollars into fossil fuels, the same ones that are destroying our environment, the same ones that governments all over the world are trying to limit or end entirely.

[00:01:21] Our own Oregon treasurer proposed the net zero plan to do just that. And these are long-term investments. We are tied into these for 10+ years with hundreds of millions of dollars in each investment.

[00:01:33] But maybe they’re growing our pension fund and making it money? Well, not so fast. Private equity investments have performed well at times, but recently not so much.

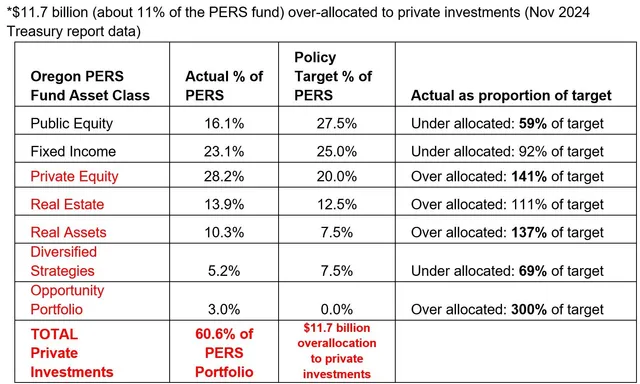

[00:01:41] That’s probably why the Treasury isn’t supposed to be heavily invested in them, but they’re way over the limit set by the Oregon Investment Council. In fact, our PERS fund is 60% invested in private investments. That’s our retirement money.

[00:01:54] So many businesses and people all over the country are hurting because of private equity. Oregon’s pension fund is at risk. Let’s stop digging the hole deeper. Get Oregon’s pension fund out of private investments and fossil fuels by passing the Pause Act. For more information go to divestoregon.org.

UPDATED March 6, 2025: A spokesperson for the Oregon Treasurer said this Divest Oregon message may be misleading to listeners.

Spokesperson Eric Engelson said the percentage allocated to private equity is limited. According to an online report, the current investment of just over $25 billion represents 26.5% of the fund, a bit closer to the 27.5% limit than to the 20% target.

Eric Engelson wrote in a March 6 email message: “Treasury manages the Oregon Public Employees Retirement Fund (OPERF) to deliver sustainable, risk-adjusted returns to help support public employees in retirement now and in the future. All of our decisions regarding investments are guided by our fiduciary duty to pension beneficiaries. Treasury shares Investment information and performance data on our agency website within the ‘Performance and Holdings’ webpage at: https://www.oregon.gov/treasury/invested-for-oregon/pages/performance-holdings.aspx

“Additionally, I’d like to provide some clarifications around the Divest Oregon statement you shared, which we feel may be misleading to listeners. Specifically with regards to ‘PERS fund is 60% invested in private investments’ and the private investments being ‘way over limit set by the Oregon Investment Council.’

“Regarding the ‘PERS fund is 60% invested in private investments,’ we interpret that statement to misrepresent our portfolio’s current asset structure. Combining a number of separate portfolio asset classes into one group, which may be inclusive of all or portions of our Private Equity, Real Estate, Real Assets, and Opportunity asset classes. If that assumption is correct, those holdings are still less than the 60% they state. A full breakdown of our asset class allocations is available in this report, updated January 2025.

“Their claim that we are “way over limit” is not accurate. As reflected in our most recent asset allocation report, these holdings are within the limits set by the Oregon Investment Council, available on page 15 of the Council’s policy statement. A quick breakdown is provided below:

- Private Equity: current 26.5%; limit 27.5%

- Real Estate: current 14.1%; limit 17.5%

- Real Assets: current 10.6%; limit 10.0%

- Opportunity: current 3.0%; limit 5.0%

- Total: current 54.2%; limit 60%

“As Treasury is committed to accurate and transparent reporting practices, we believe misleading and inaccurate statements like this regarding government activities can be harmful to the public. We greatly appreciate you reaching out and for your consideration of making any corrective notations to Divest’s statements on your website or to your listeners.”

Andrew Bogrand of Divest Oregon said this story and its initial public service announcement uses data from November 2024:

In an email message, he wrote: “In November, Oregon Treasury was over the limits set by the Oregon Investment Council (and these are the max limits, not the middle-range targets). This is an accurate statement and was not intended to mislead the public nor undermine faith in the Oregon Treasury. It is worth noting that a 60% max allocation toward private investments is high in comparison to other public pension funds in the U.S.

“We are similarly committed to transparency and provide Oregon Treasury officials with an opportunity to comment on all of our reporting and press statements. To my knowledge, Oregon Treasury leadership has not pushed back on these figures. While we don’t always agree, we have a had positive engagement with the Treasury for multiple years and have a deep respect for their staff and work.”