Wall Street land grab ‘greatest loss of Black wealth in modern U.S. history’

3 min read

DJ Suss D: The 2008 financial crisis had many causes. The banks blame the subprime mortgage market. Most experts agree it was mostly middle-class qualified borrowers who lost their houses because of a loss of good-paying jobs. Decades of trade agreements that caused outsourcing, union-busting, corporate mergers, coupled with higher education costs and a crumbling infrastructure caused good-paying jobs to all but disappear and costs for transportation and services to rise.

[00:00:30] Mortgages and rents went from one-fourth to one-third of household income. Despite low interest rates as fewer people could afford houses, prices dropped until the homeowners were stuck making payments on underwater mortgages. Since then as part of its Quantitative Easing program, the Federal Reserve has been buying these loans in the form of mortgage-backed securities to the tune of $2.8 trillion.

[00:00:53] These are the tranches or groups of loans described in the movie, The Big Short. While taxpayers won’t have to pay for this bailout, unfortunately, homeowners have not been so lucky.

[00:01:03] Tia Taruc-Myers, Director of Legal Education at the Sustainable Economies Law Center, put it this way in a workshop on the ‘Moms for Houses’ bill:

[00:01:12] Tia Taruc-Myers: During the 2008 financial collapse, we saw the greatest loss of Black wealth in modern U.S. history and the term ‘land grab’ achieved popularity around this time because large corporations began started buying farmland and foreclosed homes as a new source of revenue.

[00:01:32] During the 2008 great recession, about 5 million families lost their homes nationwide. For example, foreclosures in Richmond (just nearby) spiked more than 600 percent between 2005 and 2008.

[00:01:49] Wall Street firms then sensed an opportunity to make a big profit and started buying up single-family homes. In California, alone, Blackstone, a Wall Street firm, bought 13,000 homes. Other firms like Blackstone gobbled up homes with the help of banks that would bundle up a bunch of foreclosed properties and then sell them in so-called ‘bundled auction sales.’

[00:02:12] That’s why there are so many vacant homes creating artificial scarcities and increasing rents.

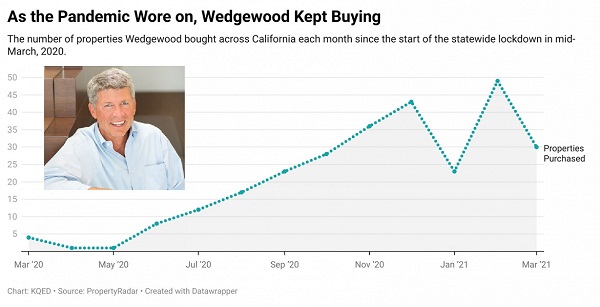

[00:02:19] And now while we’re in a pandemic and a looming economic crisis, companies like Wedgewood are going on spending sprees. This chart from KQED shows the number of properties bought in California each month since the start of the statewide lockdown in mid-March 2020.

[00:02:38] Last year alone, Wedgewood funneled at least $152 million to purchase 276 properties throughout California. And so their game plan is just to buy single-family homes at foreclosure auctions. They paint them a few shades of Gentrifier Gray, and then they flip the homes for a profit.

[00:02:58] This is Greg Geiser. He founded Wedgewood in 1985 and he calls flipping—house flipping—hot and sexy. And he says that every day. And he says this very proudly: Every day, they cover every foreclosure sale from Denver to Seattle, up through Idaho, down to San Diego. And many people have lost their jobs during the pandemic and are not able to make the rental and mortgage payments.

[00:03:23] DJ Suss D: According to a recent ProPublica article, private equity firms are buying houses that were in these mortgage backed securities at wholesale prices from Freddie Mac and Fannie Mae at an alarming rate. They then cut services, raise rents, and sell them to investors who then raise rents further to pay finance costs and return of up to 20 percent. Housing advocates are urging people to look into what they’re invested in.

[00:03:47] SB 1079, the Moms for Houses bill, gives priority to tenants and housing nonprofits over corporations during the bidding process on foreclosed homes. It also issues fines of $2,000 for dilapidated homes. SB 1079 passed in California, but needs support in order to get funding.

[00:04:06] You can help by going to California Community Land Trusts dot org. (https://www.cacltnetwork.org/)

[00:04:09] For KEPW Weekly News, I’m DJ Suss D of the show, Talk is Cheap, Saturdays at 4 p.m.