Legislature to consider funding fire-adapted communities, neighborhood cooperatives

12 min read

The upcoming legislative session will discuss wildfire funding, including money for fire-adapted communities and neighborhood protection cooperatives. On Jan. 10:

Sen. Jeff Golden: I’m Jeff Golden. I represent Senate District 3. I think it’s great we’re coming to session with the ingredients for a serious conversation on the best way to reliably fund programs that’ll keep our communities from burning to the ground and our state overall from horrific smoke episodes.

[00:00:31] We do agree that wildfire is a crisis threatening all Oregonians, that we all have to pitch in.

[00:00:37] John Q: Sen. Golden suggested restoring a timber severance tax.

[00:00:41] Sen. Jeff Golden: The timber severance tax was discontinued in the 1990s…Since the severance tax ended, forest ownership has largely shifted from companies invested in their communities to national or global Real Estate Investment Trusts (REITs), that enjoy precisely-crafted tax breaks, don’t show much interest in bolstering communities, and are contractually bound, no matter what the circumstances, to maximize return to their shareholders, who, for the most part, might have trouble finding Oregon on the map.

[00:01:17] To whatever extent possible, it’s that sector—not the small to mid-size operations based firmly and loyally in Oregon communities—that our restored severance tax should focus on.

[00:01:29] This new severance tax that we would offer up to voters would completely replace the current harvest tax, which is jaw-droppingly complex… This proposal levies a tax on the value, not the volume, of timber harvested on private lands. The rate of taxation is graduated according to the acreage of the property where harvest takes place.

[00:01:56] But what deserves the most focus, the reason for this bill, is how we’ll use the revenue. It’s divided into four buckets: 25% goes to ODF to cover almost all the elements paid for by the harvest tax we’d be eliminating, including the base fire protection piece, plus the Oregon Conservation Corps…

[00:02:18] A second 25% in this proposal goes to the Office of the State Fire Marshal for programs to reduce risk and increase the fire readiness in our communities. This is the core motivator for this bill.

[00:02:34] Let me share just a very few numbers. We’re dealing here with a segment of the overall wildfire strategy that’s titled ‘Fire-Adapted Communities’ and most of the legislation we’ve seen and we’ll see this session uses a generic label of community risk reduction. In the 2023 budget, at the direction of Senate Bill 762, we put $35 million into community risk reduction and the fire marshal used it very effectively to fortify fire service capacity and training and staffing and risk reduction activities all over the state.

[00:03:16] From the perspective of keeping our communities intact, this was a brilliant investment. This biennium, despite plenty of professional testimony about how vital these programs are, that number was slashed by more than 90%, from $35 million to $3 million.

[00:03:38] We’ll be trying to boost that total this session in a couple of different ways, including a bill that this committee is about to introduce as LC 81, which would invest $5 million in neighborhood protection cooperatives.

But my takeaway from the experience is while we can count on the current funding system to provide what’s needed to fight fires, and Doug Grafe gave detail on that when he was talking about adequate level of protection, legal requirements. We don’t have that reliability, that confidence when it comes to preventing catastrophic fires—what the fire marshal has shown her organization can do so well.

[00:04:21] When I talk about our solemn duty to do what we can to keep Oregon communities from burning down, you’ve heard me on that more than once, this is what I’m talking about. So 25% to ODF, 25% to the Office of Fire Marshal, then 40% to the counties where timber is harvested, which was one of the uses of the old severance tax and hasn’t been there since it ended. These funds would be unrestricted. Counties could use them as they choose.

[00:04:52] The final 10% would be used for protection and restoration of public water supplies on forest lands that are threatened by a combination of wildfire floods and destabilized soils. More and more Oregon towns, mostly on or near the coast, are facing serious drinking water crises far beyond their resources to solve. This unmet need is getting more severe.

[00:05:20] So once more: one quarter to ODF, one quarter to the fire marshal, 40% to the counties where timber is harvested, 10% to protect small municipal water supplies. That’s what this program would fund.

[00:05:34] And if there is another funding strategy that could meet those needs that I believe are critical, I want to find out more about it.

[00:05:42] I recently had a conversation about the bill with a timber industry executive about all this and to put it mildly, he doesn’t like it a bit. His company has significant challenges, he thinks they’re already paying enough, and in different ways, they’re doing a lot for communities. Many companies are, and Oregon’s the better for it.

[00:06:04] The obvious drawback of this proposal is how some will reflexively see it as slandering the timber industry, which so easily drops us back into the timber war mindset that has never once led to good policy solutions. I wish that weren’t the case. I’ve never once lain awake thinking up ways to make life harder for the timber industry.

[00:06:27] I’ve lain awake lots of nights—especially windy summer nights—wondering how we’re going to sustainably prevent repeats of what’s happened in Paradise and Santa Rosa and Phoenix and Talent and Otis and the towns along the Santiam and McKenzie River canyons.

[00:06:45] The challenges to our well-being—possibly Oregon’s survival—have become too big to solve with the toolkit that brought us here. The kind of changes we need won’t be easy. That’s true when it comes to homelessness and mental health, substance abuse—it is definitely true for wildfire.

[00:07:05] We’ve watched enough of our communities burn nearly to the ground, and with even drier, hotter, windier summers ahead, we’ll watch it again and again unless we bolster our communities’ readiness with reliable, tried-and-true program investments. Reliable programs means reliable funding.

[00:07:27] We all know this bill wouldn’t be a perfect answer and we all know there isn’t one. But it’s a realistic answer and I suggest we let the people of Oregon have their say this November on whether it suits the challenge in front of us. How do we afford to protect their communities, our communities, from the ravages of wildfire as our summers get hotter, windier, and drier?

[00:07:50] I welcome your ideas, the ideas of our colleagues, and all suggestions on making this proposal better before handing it to Oregon voters.

[00:08:01] Sen. David Brock Smith: In the past I have seen my private timber owners, which we just are being attacked left and right by the environmental for-profit nonprofits and others. You have a situation where a timber mill in Banks has announced that they’re closing. You have the attack from the Board of Forestry and the HCP when there’s other alternatives.

[00:08:18] We know that those managed lands of our private timber owners and the data supports that they are not contributing really to the catastrophic megafires, but that of the federal government managed lands are. Why should the private timber companies in this state carry the burden of the wildfire cost associated with federal lands that are not?

[00:08:43] Sen. Jeff Golden: That’s a fair question, Senator Smith.

[00:08:45] The timber industry is variegated, and there is no question that there are major sectors of it that are really financially challenged right now, and this is what I was referring to about the need to adjust the tiers and the rates to the fiscal realities of different companies.

[00:09:04] And I really, I am really talking about what has happened since the discontinuation of the severance tax, which was a viable approach for several decades before it ended in the 1990s and the advent of the REITs and how much of our forests they own now and what their situation is.

[00:09:25] Sen. David Brock Smith: Thank you, Senator. When we’re talking about these issues and moving forward, we have a housing problem in this state, we need resources to build those housing, those houses. We import 35% (roughly) of our logs, so that we can turn them into sticks, so we can build those houses. When we have resources right down the road.

[00:09:44] And I know that climate change is a huge issue for you, And you are very familiar with leakage. And just for those laymen out there, when it comes to leakage, carbon, trees sequester carbon. When you import trees, your emissions associated with doing so is just putting more carbon in the air. And that is called leakage.

[00:10:04] And so, I’m hoping that as we have this conversation moving forward that we can broaden it to have a more holistic view on how we solve these problems because in my opinion, in my constituents’ opinion, our timber industries are our local economic drivers.

[00:10:24] Roseburg Forest Products is investing $700 million in our local community so that we can have resources and build those homes across the state. Freres Lumber has invested millions in CLT (cross-laminated timber), which we know is one of the most fantastic and all the data and science coming out from those buildings, in the carbon sequestration benefits, but also the resiliency of those billions when it comes to fire, earthquakes, so forth. And they’re building them all over the world.

[00:10:51] But when the first tech building was built in Hillsboro—at the time a few years ago, the largest CLT building being built in the country—those materials were shipped on emissions emitting vehicles, all of them, from Vancouver, B.C. When we had the resources right down the road.

[00:11:14] And so I’m hopeful that we can come to an understanding that our timber industry folks in this state are our friends. They’re the ones that are going to be supplying the resources to build the 36,000 homes that the governor is wanting to do.

[00:11:28] And we’re, when it comes to the overall climate aspect that you are so passionate about, it does no good to create emissions by bringing in resources that store carbon in our state.

[00:11:41] Sen. Jeff Golden: I look forward to that conversation, Sen. Brock Smith.

[00:11:44] Sen. David Brock Smith: Thank you, sir.

[00:11:46] Sen. Fred Girod: Sen. Golden, I share Sen. Brock Smith’s concern about throwing all the responsibility on the timber companies. From a timber area, there’s a good chance I’d lose two mills. And one would probably close and one would probably move to Georgia or someplace like that.

[00:12:04] The question I have for you is, we got two other proposals that seem to be more balanced. And is there any one of those two that, really, that you think you could get behind?

[00:12:16] Sen. Jeff Golden: There are definitely elements. The piece in the Sen. Steiner work group that updates and indexes the fees that industry has been paying on harvest and related matters that have been flat since 2007—adjusting them for inflation sounds totally straightforward. I’m not really understanding why we haven’t done that so far. I’ll be in full support of that.

[00:12:44] The larger and clearly more controversial piece, and in some ways this is shared with Rep. Evans’s proposal, is taking the next major chunk of resources to pay for wildfire from the general public at large, on the premise that this is an all-Oregon problem and we need all hands on deck. I think that premise is exactly right. We all need to be involved with this.

[00:13:12] What the conversation has to include is: ‘How are Oregonians all paying right now today?’ And it would be very interesting to hear from some of the fire protection districts and the big challenges they’re having with their patrons, their citizens, as they’re needing to increase their costs, what those folks are paying now. In some cases, it even applies in cities, with increased fees from fire departments.

[00:13:40] Which is to say nothing of the general income tax that Oregonians all pay now, some of which goes to wildfire. So the question is not, ‘Should all Oregonians pay for wildfire?’ It’s: ‘How much are they paying now, and is it time to ask them to pay more?’

[00:13:57] My view is that it’s unbalanced to say to Oregonians, ‘We’re initiating a new fee that’s never been here before,’ which by the way, they’re naturally going to see as a Pandora’s box, and what else are we going to load onto that fee as we have other big needs over the years. But we’re going to do that now with a proposal that actually cuts costs for some of the biggest operations, and call that ‘equitable’ and ‘all hands on deck.’

[00:14:26] So the conversation I’d be interested in is: Is there some possibility for integration where you’d look at a general fee or tax of some kind in return for some of what we lost in the severance tax and especially the type of organization (which I don’t think are the mills in your district, Senator) that are paying significantly less than they did when the severance tax ended?

[00:14:54] That’s the conversation: Where’s the balance point? I couldn’t support a general assessment in the absence of some kind of contribution from the organizations I’ve been talking about.

[00:15:07] Sen. Fred Girod: I’m going to make a brief comment here. And it was something I found really interesting. And that is: We lost 645,000 acres on average in the last 10 years, but 10 years prior to that, we only lost half of that. And 10 years prior to that we lost another half.

[00:15:27] I know climate change could be part of that. Mismanagement can be part of that. But the facts are still clear that, you know, 20 years ago, we didn’t have that much damage to our forest. And I would like to suggest that there’s been a change in how we approach fires. It used to be. We tried to put him out in 24 hours, especially on federal land.

[00:15:53] And so I would like to add a fourth possible answer to the solution. And I talked to Sen. Golden about this and others, and that is that we fund four Blackhawk 70 helicopters that are designed to fight fires. The cost of that would be between $100 and probably $125 million. And that we would do that through capital construction. And then if we do go on to federal forest land, we bill them.

[00:16:20] I understand that there is a lag time between the billing of that, of our services and getting paid. But I do think that that is something that we need to consider.

[00:16:30] John Q: On Jan. 10, Legislative Concept 81 was introduced. It would fund neighborhood protection cooperatives.

[00:16:40] Laura Kentnesse (Legislative analyst): LC 81 relates to wildfire risk reduction. The legislative concept would direct the state fire marshal to collaboratively establish a neighborhood protection cooperative grant program for property owners to promote community wildfire resilience. The concept would also direct the Department of Consumer Business Services and other agencies in consultation with insurance industry representatives to develop a plan for a risk reduction certification program that relates to underwriting and insurance premium rates.

[00:17:11] Sen. Jeff Golden: LC 81 about the neighborhood protection cooperatives: This committee passed a bill almost identical to it last session. It was Senate Bill 509. It was referred to Ways and Means and didn’t get out of there. Didn’t get funded.

[00:17:27] And we’ll talk about it more later, but I did want to mention there’s an extra step that it takes, where we’re asking our insurance commissioner to develop a report about how do we move to a system where people who do what they can to minimize wildfire risk on their property are rewarded through their insurance premium rates, not through government at all, through a private-sector way.

[00:17:53] That has a lot of complexity to it, but we are trying to move to a time where people who do everything reasonable to minimize risk on their properties have access to affordable insurance and that this bill takes a step in that direction.

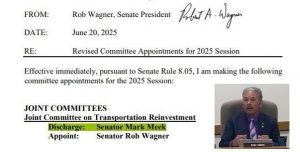

[00:18:09] John Q: In February, the legislature is set to discuss wildfire funding. One proposal would give 25% of a timber severance tax for fire-adapted communities, with another proposal allocating $5 million for neighborhood protection cooperatives.