Dylan Lamar does the math: Co-op + community land trust = Affordable home ownership

6 min read

Dylan Lamar described the affordable home ownership model model offered by Springfield's C Street Co-op.

Dylan Lamar spoke to the Northwest EcoBuilding Guild this week. Springfield’s C Street Co-op is creating affordable home ownership for less than it takes to build rentals.

[00:00:12] Dylan Lamar: My name’s Dylan Lamar, I’m an architect and developer and owner at Cultivate in Eugene, Oregon. I’ve been down here for about three years. I was 10 years with Green Hammer in Portland, I designed Tillamook Row, a 16-unit courtyard apartment net zero project, wonderful project, extremely sustainable, very walkable neighborhood, very well integrated into a historic neighborhood.

[00:00:37] And I really struggle with the fact that while I want everyone to live in sustainable housing, there are so many people who are not living in any housing at all. And my move into the development world is an attempt to allow everyone to access more sustainable housing. And I’m trying to kind of marry those two worlds.

[00:00:57] Home ownership is such a critical key to creating economic stability for families. So in Oregon, we have new legislation that will come into effect this summer that’s re-legalized middle housing. This is probably the biggest housing development opportunity I’ll see in my lifetime, if I were to venture a guess. It’s pretty huge. It’s going to allow internal conversions of houses, ADU additions, multiplexes and townhouse infill, many options on the table, on our historically single family zones, which are the majority of the land area of most cities in America.

[00:01:30] My main question with all this development opportunity is, where’s the homeownership opportunity? There’s basically three pathways to home ownership, and we generally only talk about two.

Thank you for supporting

local civic journalism

[00:01:39] Fee Simple is where you own a single house on a single lot, or a landlord owns a single property on a single lot. For those in Oregon where you’re allowed to have a fourplex on a single lot, you can now divide that lot into four lots so that each house can be on its own lot. This will definitely improve the likelihood of fee simple ownership.

[00:02:01] Condominium, this is where you have some shared elements that needs to be owned in common.

[00:02:06] A third category, Cooperatives, exist for the same reasons for condominiums— ownership— as cooperatives can allow shared ownership of a single structure on a single lot. With a co-op you have a share of the co-op corporation that owns the entire thing. And then your ownership allows you a lease to lease your dwelling unit. So essentially you’re a renter of your own corporation, and you’re one of the owners of that landlord corporation, if you will. And it’s operated at cost, so while you’re renting from yourself, nobody is scraping profit off the top. It’s all operated at cost.

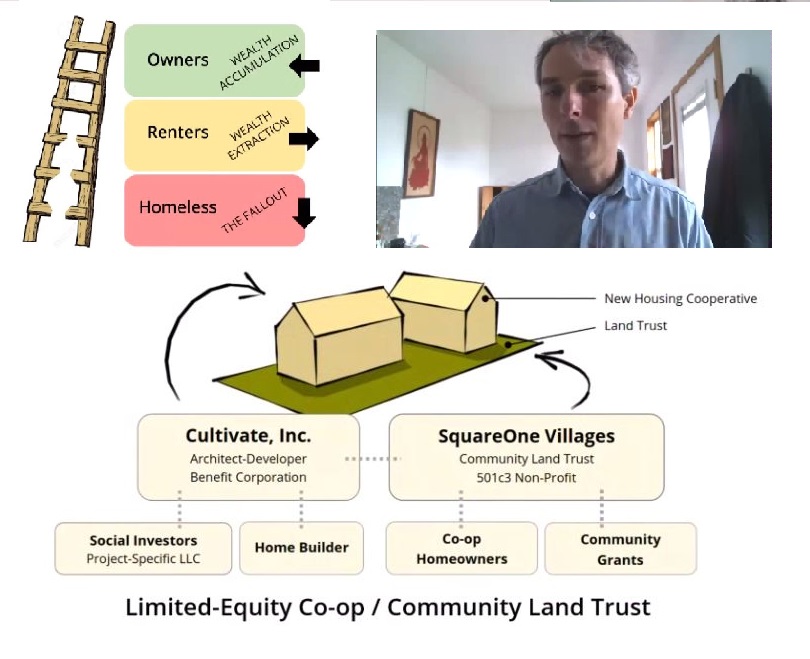

[00:02:39] A little about the structure for those that are interested. It’s a limited equity co-op it’s also a community land trust. My company basically did the design and development. We brought five social investors together to provide the construction loan. And then I hired the builder. We built the thing. Square One Villages, a local nonprofit who you might know from of tiny house village fame, they are acting as the community land trust. They brought the subsidy to the table. They organized, the homeowners, found the homeowners, organized them into a co-op, and they will own the land in perpetuity.

[00:03:10] The main function here of the relationship between a limited equity co-op and a community land trust is the land trust ensures that the limited equity co-op never changes its bylaws to unlimit its equity.

[00:03:21] Aside from dealing with securities regulations, which were a real headache, it was surprisingly easy to find people who are interested in lending money for this. So we found a local bank who was interested in supporting the project and they’re going to hold that loan forever. They’re not going to try to sell it upstream to Wall Street, so it didn’t have to meet the criteria for such loans.

[00:03:42] So the benefits of limited equity co-ops are fixed housing costs. That’s the primary benefit. So this is the cool part: The total development costs were less than half for this project. The total subsidies we needed were less than 10% of the subsidy needed for affordable rental housing. And we’re delivering permanent home ownership here for a $10,000 purchase price. And for folks who had trouble with that, Square One, the nonprofit I partnered with on this, was able to help provide what they call a share loan to help support that price. $770 a month total owner costs, that includes utilities and maintenance. Market rate right now is $920. And, if you look ahead 10 years, it’s going to be a lot more than that. So again, the affordability is only going to increase over time.

[00:04:26] Right now, the $770 a month corresponds to 60% AMI households here. So that’s the same affordability threshold as most affordable rental housing. So often those projects are using $250,000 of subsidy. That’s taxpayer dollars to create that housing. Why are we as taxpayers not insisting they provide limited equity co-ops that can deliver ownership for even less money?

[00:04:50] This opportunity we have, to develop limited equity co-ops with the middle housing that we’re going to see in coming years, coming decades, I think it’s a huge opportunity to expand home ownership access beyond just the middle-class that it’s historically been for. I mean, first we’ve got to start by preserving it for the middle class, but even then, expanding it to populations that have been historically marginalized. And sustainability for all. So with that ladder of housing, we’ve still got our owners at the top with their conventional forms of ownership. They’re still making money doing that, but we’ve also got, for everyone else, limited equity co-ops, where they’re able to secure permanent affordable housing.

[00:05:31] I’m working with EcoNorthwest, which is a Portland think tank, on finance and development, and we’re working on a white paper policy brief on limited equity co-ops right now. If you want to check in on their website, my guess is in another month or two, it’ll be ready. You can check out my website or if you’ve subscribed to my website, to the newsletters, you’ll be sure to see a little email blast about it. Ultimate place dot com.

[00:05:53] John Q: Dylan said permitting is easier in Springfield than Eugene.

[00:05:58] Dylan Lamar: Frankly, Eugene is the most NIMBY town in Oregon and has just posed as much obstruction to housing development as they can. And this is coming from mostly the neighborhood associations, not from the city itself.

[00:06:11] John Q: He was asked for some final thoughts.

[00:06:13] Dylan Lamar: Um, just to, to be a housing advocate. When you hear your neighbors complaining about them allowing triplexes down the street or whatever, don’t just nod and disagree. Talk to them about it. Be like, ‘Oh, what are you worried about with triplexes?’ It really, there’s a lot of resistance to the idea of more housing. And it’s because people right there on their given street, don’t connect the housing that is not on their street with the homelessness that’s a few blocks away. And that disconnect between housing access and homelessness, surprisingly it’s not intuitive for people and I think it’s really, especially us that are in the building industry can really do a lot to help educate people about the need for more housing and how dire and increasingly dire that problem’s becoming.